Christopher A. Farrell

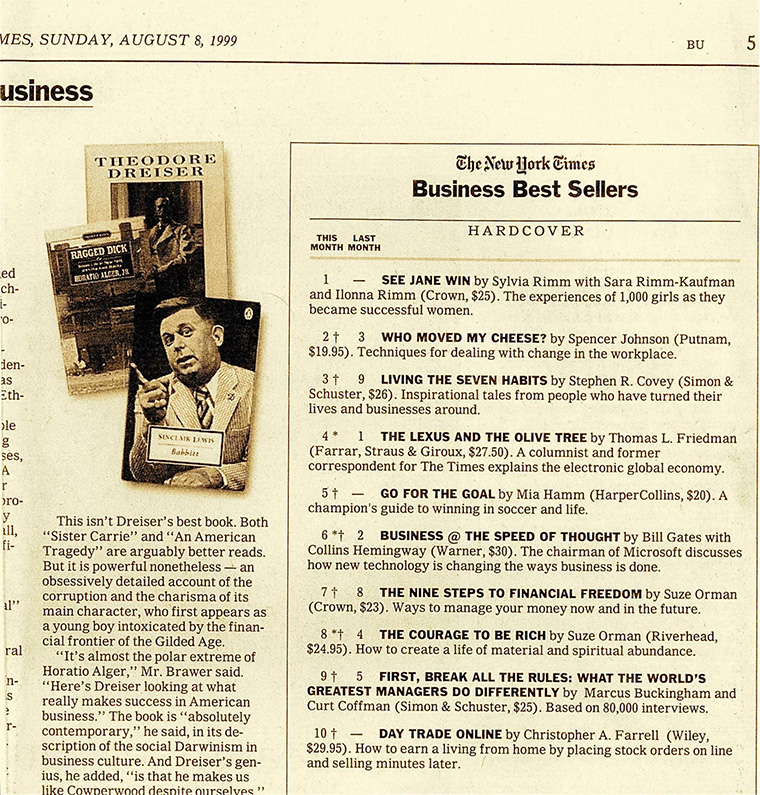

CHRISTOPHER A. FARRELL is a national bestselling author of two books, Day Trade Online and The Day Trader’s Survival Guide. He is a former Wall Street bond trader and currently runs the Farrell Preferred Stock Arbitrage Fund, LP, a hedge fund. Written as a first time author at the age of 25, his book Day Trade Onlinebecame a New York Times, Wall Street Journal, BusinessWeek and USA Today “business” best-seller, and he has been a guest on numerous television and radio programs, including CNBC , BBC World News, and Fox 5 Good Day New York. His works have been featured in magazines such as The Wall Street Journal, BusinessWeek, Worth and Online Investor Magazine and he has been a guest speaker atMassachusetts Institute of Technology (M.I.T.). Chris has also written articles on trading for Active Trader Magazine. Farrell’s books have been translated into numerous languages worldwide, including Korean, German, Russian, and Italian. Farrell has over 13 years of trading experience and has traded over 3 billion dollars worth of stock since he began. He is a graduate of Colgate University, and lives in New York City.

Farrell’s Trading Philosophy

- Wall Street is in the business of trading against its customers, and earns its profits at the expense of the investing public.

- The day trader earns his or her profits at the expense of Wall Street, by beating it at its own game.

- Day trading has very little to do with long-term investing. The time horizon on the day trader is so short that, in general, the principles of buy-and-hold investing do not apply.

- Day trading is the art of anticipating and exploiting temporary supply and demand imbalances in the trading of stocks. Some imbalances may last for several hours, minutes, or only seconds.

- Opportunities for day trading exist because, in the short term, the stock market is inefficient, irrational, and imperfect. The system is flawed and can be exploited for quick profits.

- The system is flawed because in stock trading, as in a casino, the odds are always with the house. Over the long term, the house always wins.

- The house, in this case, is the Wall Street firms who control the trading in stocks, namely, the specialists on the floor of the New York Stock Exchange and the market makers on Nasdaq. The house always wins because of a mechanism called the bid-ask spread. When the house wins, the investing public loses.

- The majority of day traders lose money. This is because the system is geared toward their failure. In other words, because of the bid-ask spread, it is very difficult for day traders to be consistently profitable by betting against the house—trading against the Wall Street firms. If you bet against the house long enough, eventually Wall Street will have all of your money.

- Day traders should only trade when they have an edge, when the odds are in their favor. Even though the odds are usually against them, there are numerous times throughout the trading day when the odds swing drastically into the day trader’s favor, and that is when they must place their bets.

- The only time the odds are truly in their favor is when they trade with the house, by being on the same side of the trade as the traders on the floor of the New York Stock Exchange (the specialists) When the specialists are risking their own capital to buy, so, too, should the day trader.

- Unlike the casino, the New York Stock Exchange has rules in place that allow individual traders to bet with the house. This gives traders the same edge and access to profits that Wall Street has always had. This is buying on the bid and selling on the ask. The investing public is generally not aware that these favorable rules exist, and that is key to the day traders’ profits.

- Buying on the bid and selling on the ask is called exploiting the bid-ask spread, and it is the way day traders take food out of Wall Streeters’ mouths. The practice of exploiting the bid-ask spread is called scalping.

- By exploiting the bid-ask spread, day traders can make consistent, lower-risk profits even in stocks that don’t move. The stock does not have to go up or down for day traders to make money.

- The fact that day traders can make money in stocks that don’t move means they don’t have to trade volatile stocks to make a living.

- The recent changes to the structure of the New York Stock Exchange, including the move toward a hybrid-electronic trading model and the increased transparency of the NYSE specialists’ order books, have benefited the investing public immensely. As a result, it has created trading conditions that are much more favorable to short-term speculators than they had been in the past.

- Although the playing field is still not truly 100 percent level, these changes to the NYSE have decreased the trading edge that NYSE specialists have over the trading public, and in the process, have greatly increased the day traders’ opportunities to “bet with the house.” So how do you bet with the house? I have written two books devoted to answering that question.